5 Most Undervalued Chip Stocks Right Now: Value Sense Algorithm's Top Picks

5 Most Undervalued Chip Stocks Right Now: Value Sense Algorithm's Top Picks

Blog Article

The semiconductor industry has experienced significant volatility recently, creating potential opportunities for value investors. After analyzing market data, we've identified five chip stocks that appear substantially undervalued according to our proprietary algorithm. Here's an in-depth look at each company and why they made our list.

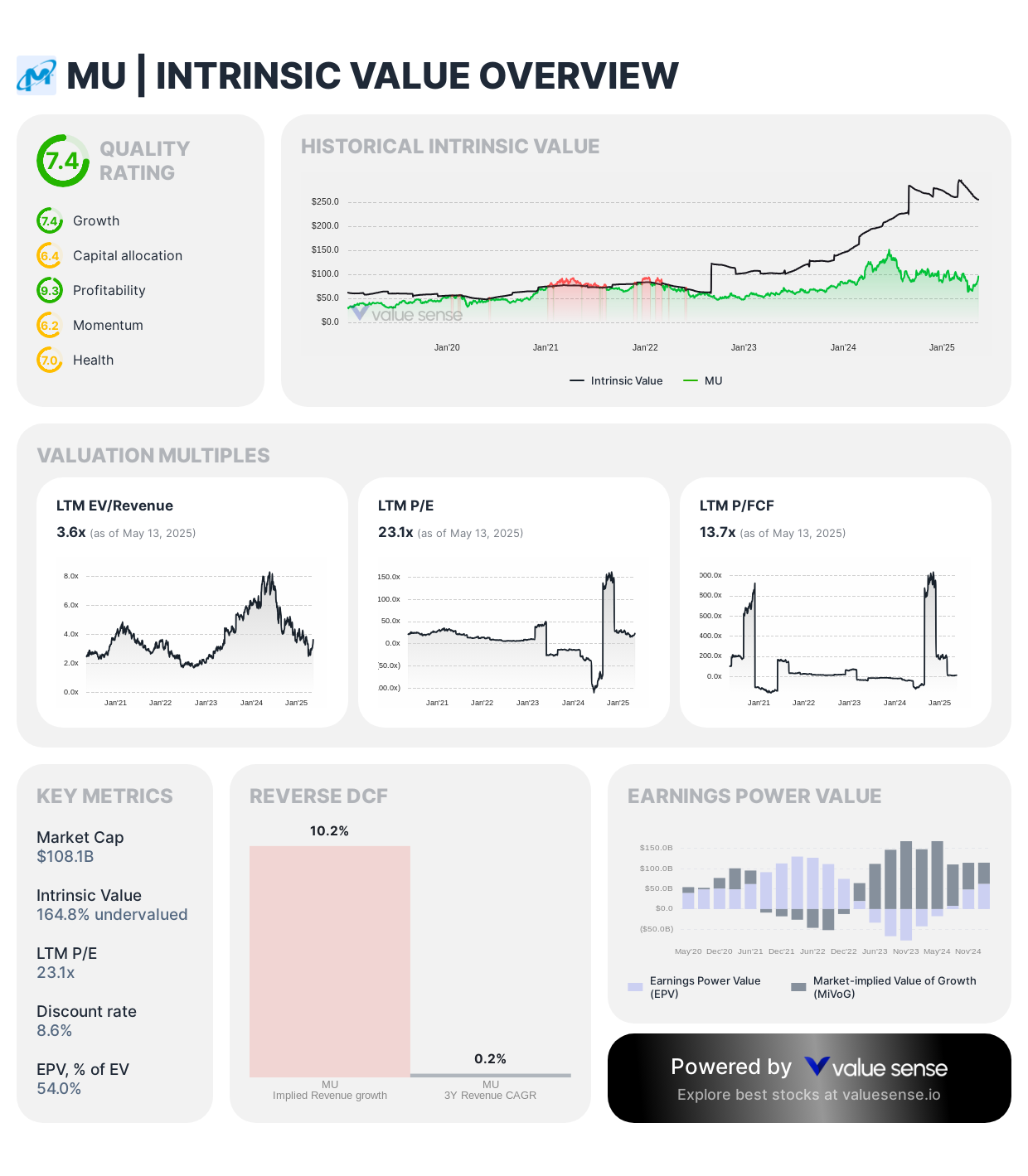

1. Micron Technology (MU): The Memory Giant

Current Valuation Status: 164.8% Undervalued

- Market Cap: $108.1B

- Intrinsic Value: $256.7 per share

- Quality Rating: 7.4/10

- LTM P/E: 23.1x

- Free Cash Flow: $7.87B

Micron's valuation metrics suggest significant upside potential. The company maintains strong profitability with negative 20.9% returns while generating substantial free cash flow. As a leader in memory and storage solutions, Micron's position strengthens as data center demand and AI applications continue to grow.

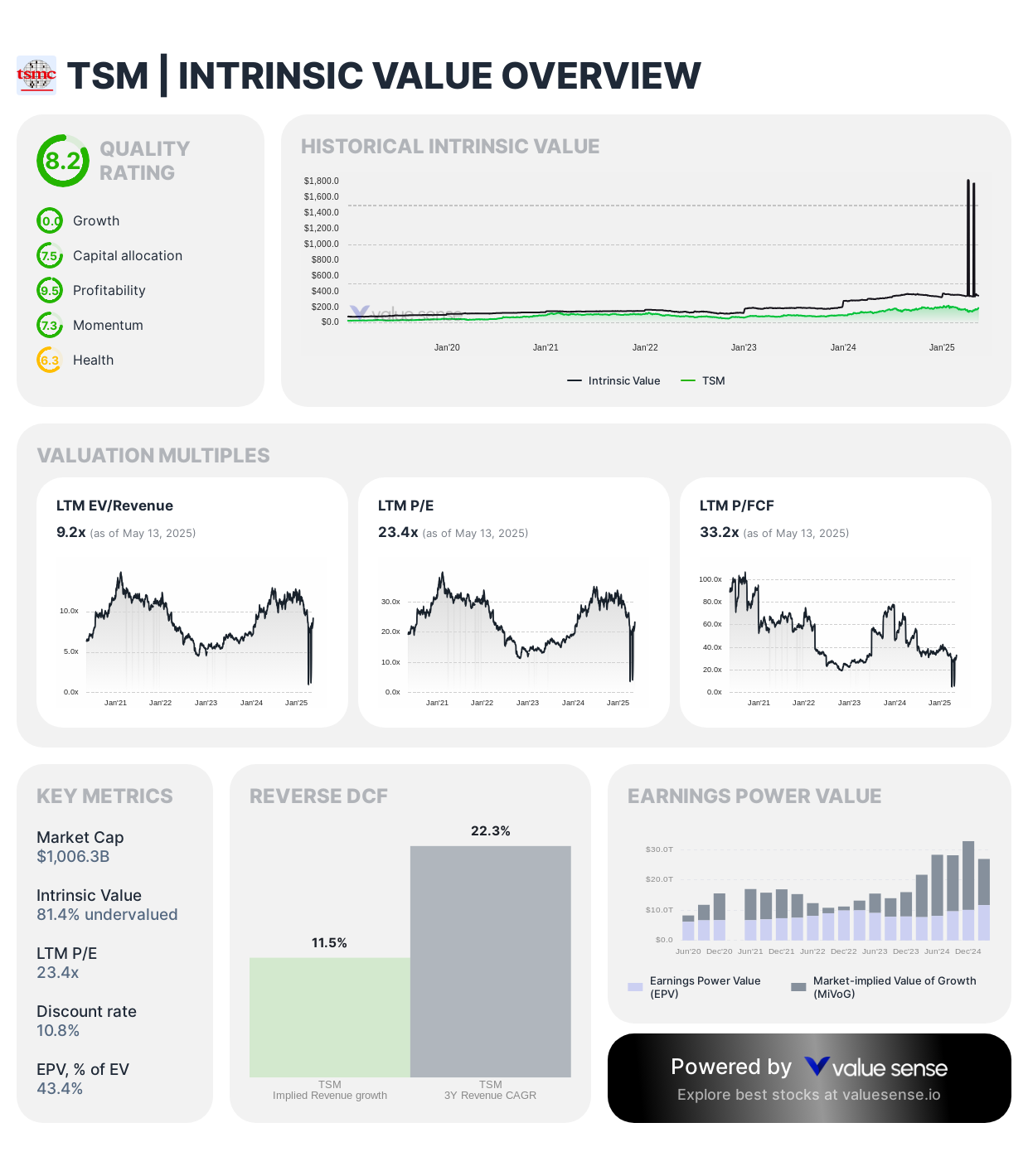

2. Taiwan Semiconductor Manufacturing (TSM): The Foundry Leader

Current Valuation Status: 81.4% Undervalued

- Market Cap: $1.006T

- Intrinsic Value: $352 per share

- Quality Rating: 8.2/10

- LTM P/E: 23.4x

- Revenue: $3,140.9B

TSM's dominant position in advanced chip manufacturing makes it indispensable to the tech industry. Despite geopolitical concerns, the company's exceptional quality rating and consistent profitability support its undervalued status.

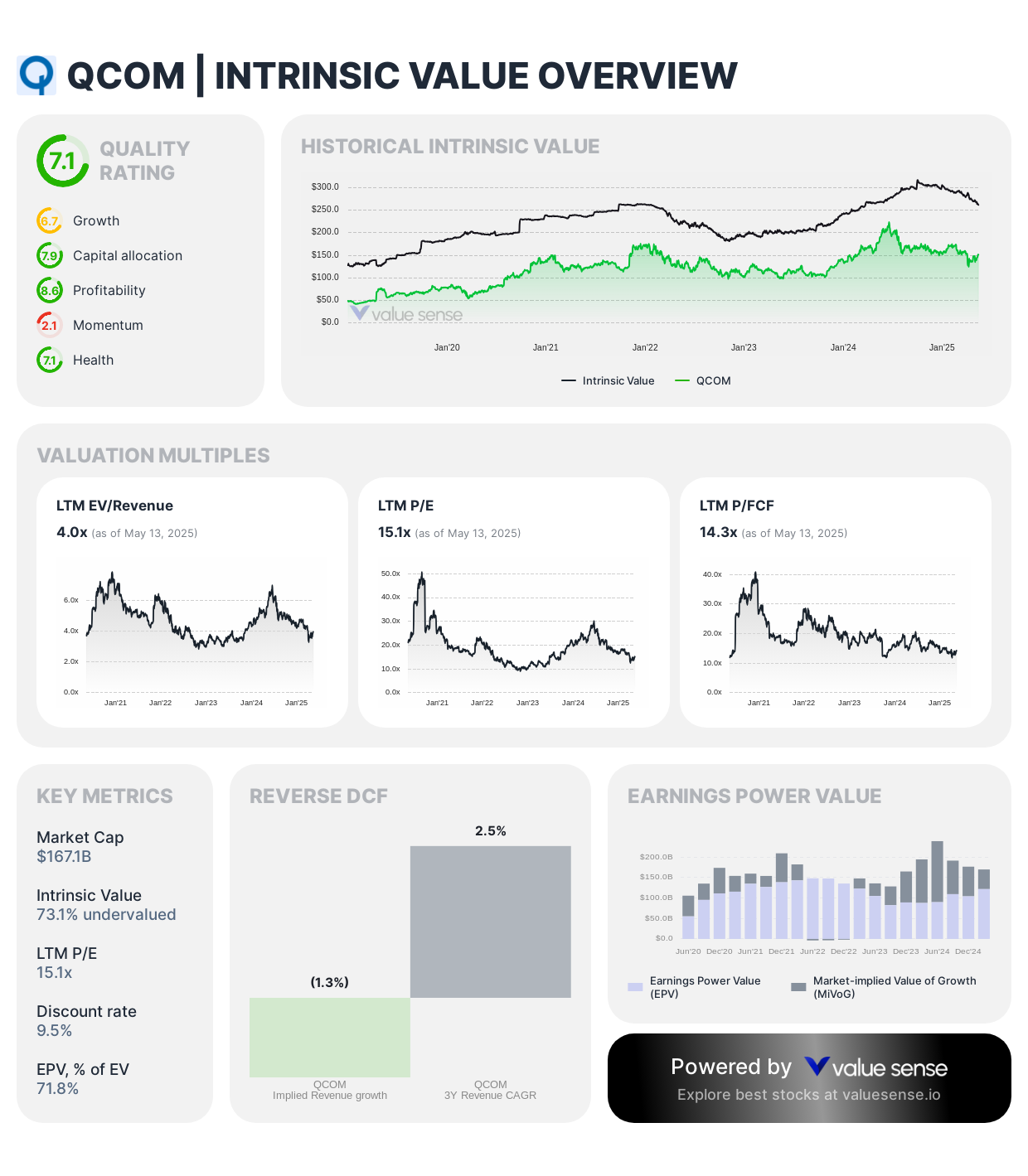

3. Qualcomm Incorporated (QCOM): 5G and Beyond

Current Valuation Status: 73.1% Undervalued

- Market Cap: $167.1B

- Intrinsic Value: $261.9 per share

- Quality Rating: 7.1/10

- LTM P/E: 15.1x

- Free Cash Flow: $11.7B

With strong positions in smartphone chips and expanding automotive markets, Qualcomm's 16.1% revenue growth demonstrates its successful transition beyond traditional mobile markets.

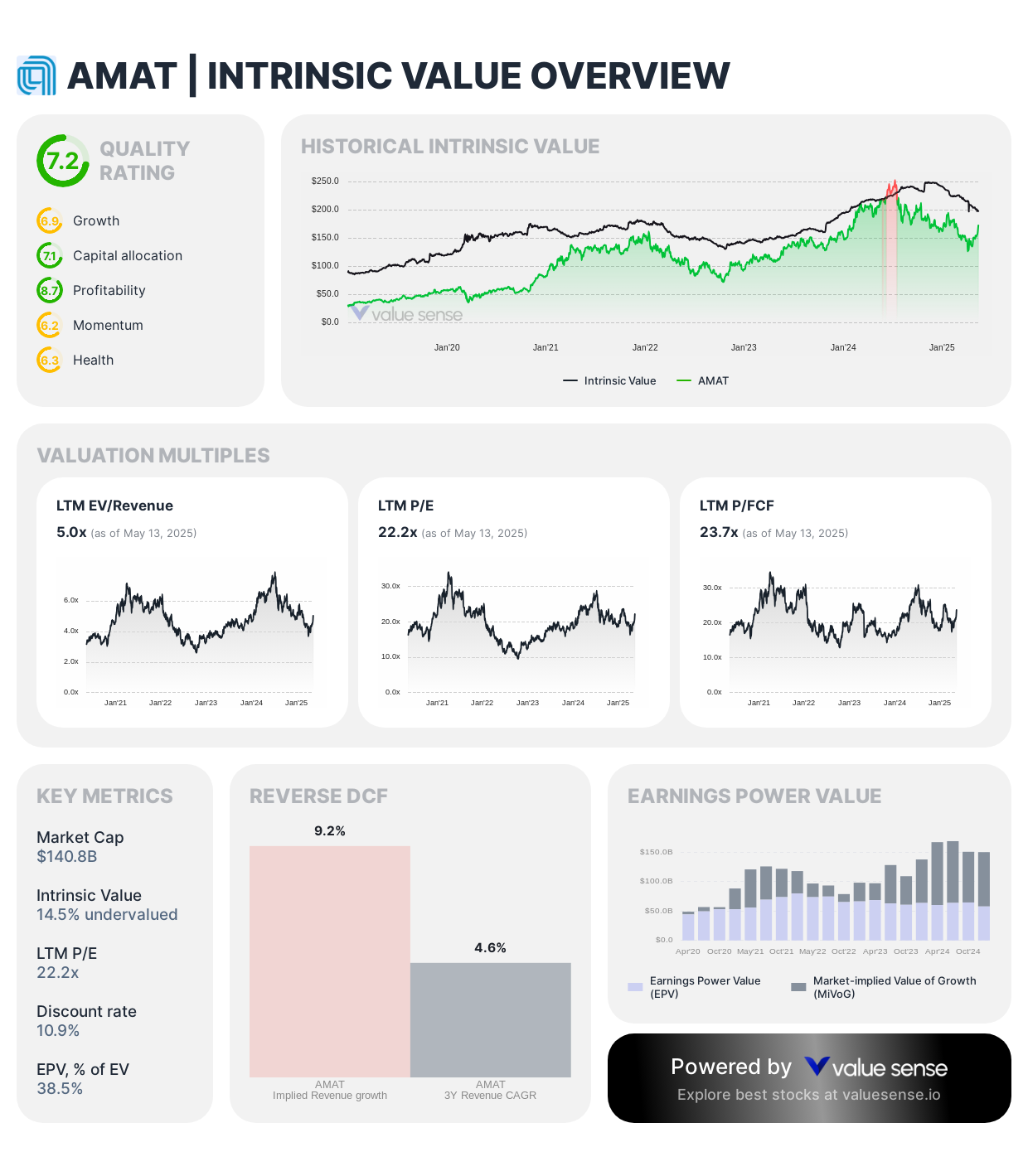

4. Applied Materials (AMAT): Enabling Chip Innovation

Current Valuation Status: 14.5% Undervalued

- Market Cap: $140.8B

- Intrinsic Value: $198.2 per share

- Quality Rating: 7.2/10

- LTM P/E: 22.2x

- Free Cash Flow: $5.94B

As chip complexity increases, AMAT's equipment becomes more essential. The company's 38.5% earnings power value percentage indicates strong operational efficiency.

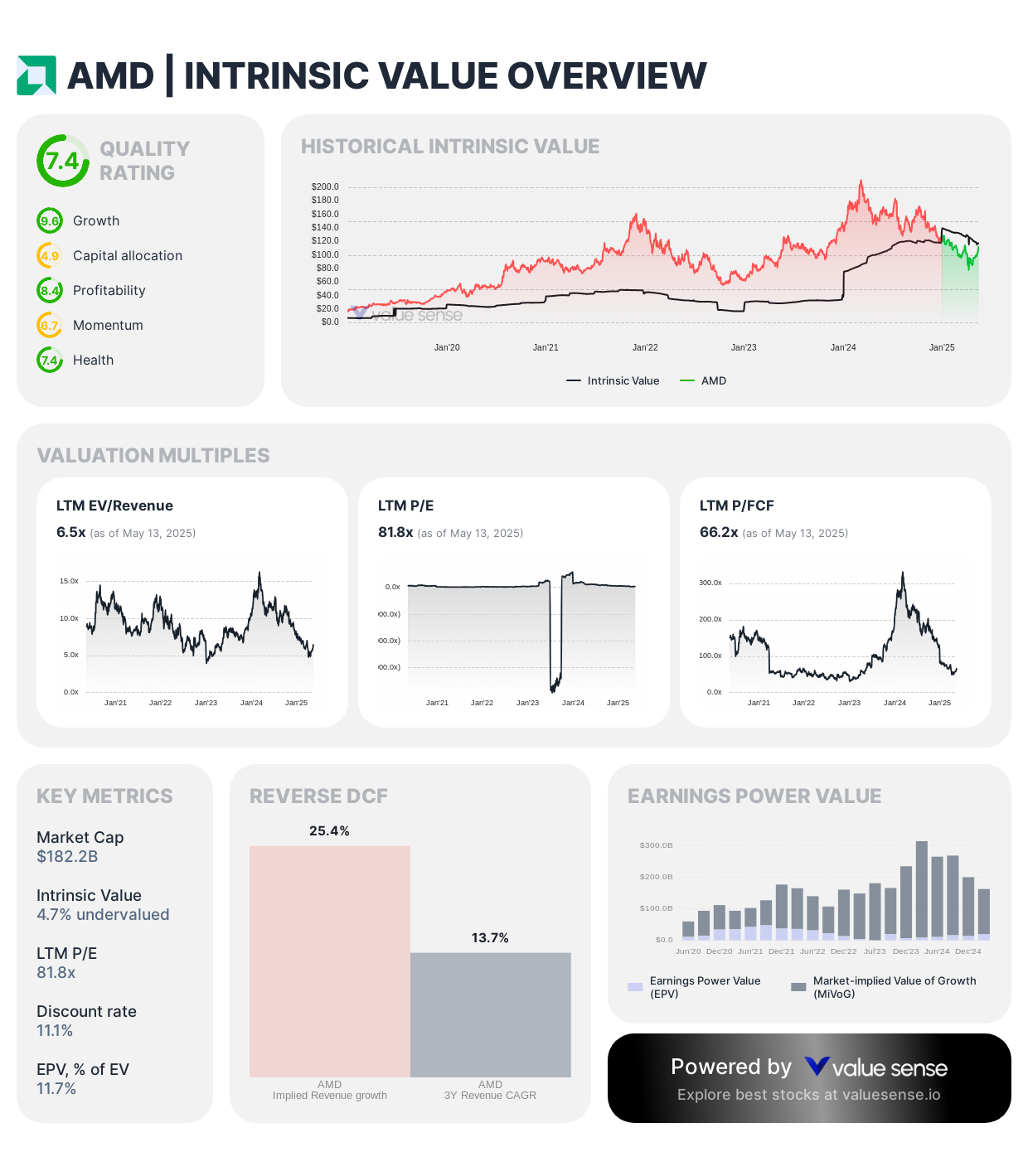

5. Advanced Micro Devices (AMD): The Data Center Disruptor

Current Valuation Status: 4.7% Undervalued

- Market Cap: $182.2B

- Intrinsic Value: $117.8 per share

- Quality Rating: 7.4/10

- LTM P/E: 81.8x

- Revenue Growth: 21.7%

Despite its high P/E ratio, AMD's aggressive market share gains in data centers and AI accelerators justify premium valuations. The company's discount rate of 11.1% reflects moderate risk levels.

Investment Considerations

Key Factors Supporting These Valuations:

- AI Revolution: All five companies benefit from AI infrastructure buildout

- Supply Chain Stabilization: Post-pandemic recovery improving margins

- Diversification: Expansion beyond traditional markets (automotive, IoT, edge computing)

- Strong Cash Flows: Healthy balance sheets supporting R&D investments

Risk Factors to Monitor:

- Geopolitical tensions, particularly US-China relations

- Cyclical nature of semiconductor demand

- Potential overcapacity in certain chip segments

- Technology transition risks (especially for memory manufacturers)

Conclusion

Our algorithm identifies these five semiconductor stocks as presenting compelling value opportunities. Each company demonstrates:

- Strong quality ratings (all above 7.0)

- Significant gaps between market price and intrinsic value

- Robust cash flow generation

- Strategic positioning in growth markets

While past performance doesn't guarantee future results, these undervalued chip stocks merit consideration for investors seeking exposure to the semiconductor sector. The combination of fundamental strength and valuation discounts could provide attractive risk-reward profiles for patient investors.

Disclaimer: This analysis is based on algorithmic calculations and should not be considered investment advice. Always conduct your own research and consult with financial professionals before making investment decisions. Report this page